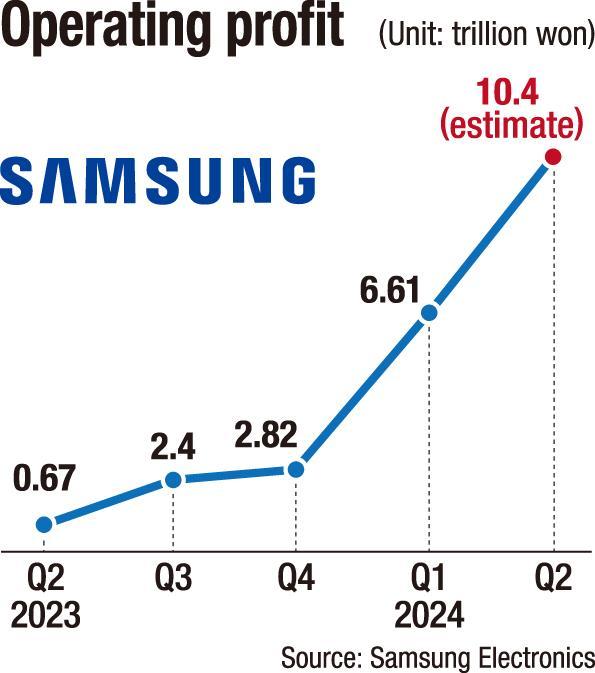

Samsung Electronics posted an operating profit of 10.4 trillion won ($7.54 billion) in the second quarter, thanks to strong memory semiconductor sales, according to the company Friday.

The operating profit surpassed 10 trillion won mark for the first time in seven quarters since recording 10.85 trillion won in the third quarter of 2022.

In its preliminary earnings report, Samsung said it achieved sales of 74 trillion won and an operating profit of 10.4 trillion won in the second quarter. Compared to the same period last year, sales increased by 23.31 percent, while operating profit surged by 1,452.24 percent.

Samsung only disclosed preliminary results without revealing segment-specific performances. Detailed results by business division will be announced on July 31.

Its second-quarter operating profit significantly exceeded market expectations, as analysts had estimated the company might log around 8.3 trillion won, according to financial information provider FnGuide.

Industry watchers view that the memory semiconductor business drove overall performance growth. Increased demand for memory semiconductors led to rising prices for DRAM and NAND flash chips and expanded sales of high-value-added products improved profitability.

According to TrendForce, a market researcher specializing in the semiconductor sector, prices for DRAM and NAND flash memory chips rose by 13-18 percent and 15-20 percent, respectively, in the second quarter. Due to these product price increases, Samsung’s Device Solutions (DS) Division, responsible for its chip business, is expected to have generated an operating profit of about 6 trillion won.

Samsung’s mobile business, another pillar of the company’s earnings along with chips, is expected to have seen both sales and operating profit decrease compared to the first quarter as the effect of new product launches waned.

“In the second quarter, it is estimated that Samsung Electronics’ smartphone and tablet PC shipments recorded 53 million and 7 million, respectively, but Galaxy S24 series sales decreased to 8.1 million, and profit margins declined due to increased memory product costs,” said Kim Sun-woo, an analyst at Meritz Securities.

Looking ahead to Samsung’s second-half performance, industry analysts anticipate the company will continue to post good earnings thanks to continuously rising memory semiconductor prices.

TrendForce expects the average sales price of DRAM to rise by 8 to 13 percent in the third quarter, while NAND flash chips are expected to increase by 5 to 10 percent.

“Comprehensive profit increases are expected in the semiconductor, display and mobile businesses in the coming third quarter,” the Meritz Securities analyst said.

To further improve future performance, the consensus is that Samsung needs to be confident that its high-bandwidth memory chips will be used in Nvidia’s AI-focused graphics processing units.

>>> Join Korean stock investment today, access new markets and seek opportunities for big profits with Bucket-VN experts:

- Sign up for free consultation and catch signals of the Korean stock market at: https://bucketvn.com/en/register/

- Hotline: 028 3636 6553

- Group Facebook discussion: https://www.facebook.com/groups/bucketvn

Tiếng Việt

Tiếng Việt