Morgan Stanley PE (CEO Hoi-Hoon Jeong) signed a contract with Asia Pulp & Paper Group (APP) to sell 100% of MSS Holdings (MSS).

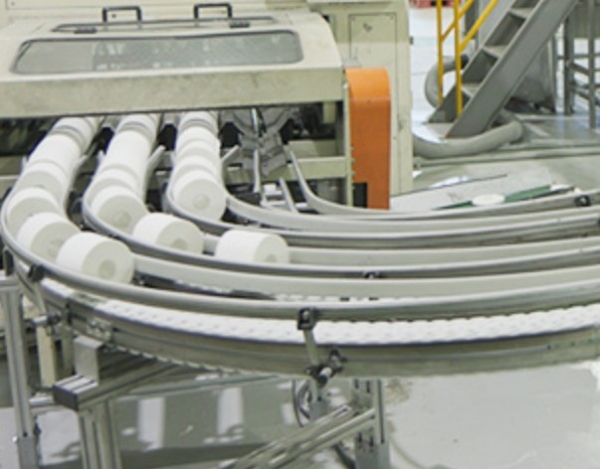

MSS has Cody and Mona Lisa under its umbrella, and produces and sells a wide product portfolio including tissues, wet tissues, sanitary napkins, and diapers. In addition, it has a vertically integrated business model based on competitiveness across the entire sanitary paper industry value chain, from procurement and production to sales and distribution.

Morgan Stanley PE CEO Hoi-hoon Jeong said, “During the period of ownership by Morgan Stanley PE, MSS was transformed into a leading comprehensive household hygiene group through a differentiated multi-brand strategy, product portfolio diversification, and efficient organizational operation.” He added, “During the company’s growth transition period, “I am pleased to be a single shareholder of MSS, and I am even more pleased to take the next step forward with the support of a new strategic shareholder.”

MSS is expected to benefit from APP’s operational expertise and global network. In particular, it is expected to achieve various synergy effects, such as advancing MSS’s domestic brand into the global market while improving productivity and cost competitiveness. APP has also been able to take its position in the domestic toilet paper and sanitary products market through MSS’s brands familiar to consumers and its nationwide sales network.

Nishant Grover, CEO of APP’s Tissues International, said, “We are pleased to acquire MSS. Through MSS, we will provide APP’s world-class high-quality toilet paper and sanitary products at competitive prices, making it the choice of Korean consumers. “We will expand the scope further,” he said.

APP, founded in 1972, is a global pulp and paper manufacturer that sells pulp, tissue and a variety of paper and packaging products in more than 150 countries. The head office is located in Indonesia.

Meanwhile, Morgan Stanley PE is Morgan Stanley’s Asian private equity investment division. The focus is on management rights buyouts and structured equity investments targeting growth companies.

>>> Join Korean stock investment today, access new markets and seek opportunities for big profits with Bucket-VN experts:

- Sign up for free consultation and catch signals of the Korean stock market at: https://bucketvn.com/en/register/

- Hotline: 028 3636 6553

- Group Facebook discussion: https://www.facebook.com/groups/bucketvn

Tiếng Việt

Tiếng Việt